It?s finally November 1st, and it means that for the first time in history, the Money Mustache family is running on a fully unsubsidized health insurance plan which we?ve paid for out of our own pocket. Isn?t that scary?

It?s finally November 1st, and it means that for the first time in history, the Money Mustache family is running on a fully unsubsidized health insurance plan which we?ve paid for out of our own pocket. Isn?t that scary?

As noted in past articles, I?ve had a pretty cozy health insurance situation up to this point. Growing up in Canada, I was blissfully unaware of the issue, since like virtually all other rich nations, that country provides universal healthcare for all citizens. I took advantage of that system for exactly two major health events: being born in the early 1970s, and a broken ankle after a bike accident in the late 1990s. Both times, the hospital got the job done well.

Moving to the United States, I found the choice of employer-offered health insurance plans confusing, so I just went with the cheapest one. Occasional gaps in coverage occurred as I hopped between employers throughout the early 2000s, but I didn?t notice since I was fortunate enough to have no occasion to visit a doctor during those years.

Then early retirement came and my wife was kind enough to throw me under the umbrella of coverage offered by her part-time employer for the last five years. Although I was grateful, I was not able to take advantage of the insurance outside of an annual visit to the doctor for a checkup. But it did help out greatly by paying most of the bill for the hospital birth of our son.

At last, she quit her part-time job, the free insurance ended, and we were forced to think for ourselves earlier this fall. So all of the health history above went into?deciding how to cover ourselves for the rest of our adult lives, during which we will probably never be conventionally employed again.

The thing about insurance is that it is best enjoyed as a game of numbers and probabilities ? not feared as a nightmare of imagined outcomes. As I noted long ago in Insurance: A tax on people who are bad at math?, there are only two situations in which I buy insurance:

- If I am significantly riskier than the insurance company thinks I am, or

- If the consequences of being uninsured would be too disastrous for me to handle, yet still have a reasonable chance of occurring

For car insurance, the choice is clear: my car is worth about $7,000 right now, so if I destroyed it in a crash, replacing it would not make a big dent in the ?Stash. Plus, I?ve never been in an accident, and my car lives in a cozy garage and rarely get used (meaning I am probably even less risky than the insurance company expects). So I don?t buy collision or comprehensive insurance.

Health insurance is different: medical care is expensive in the US, with lifetime costs for major conditions potentially reaching to a million dollars or more. On top of that, my young son is a wild card who is more likely than me to injure himself while playing, and I still have the slightly dangerous hobbies of mountain biking and snowboarding. We may even be slightly riskier than the insurance company estimates, making the choice to buy health insurance a positive one.

The next step was looking at our own health care spending over the 13 years we?ve lived in the US:

- From 1999-2005, costs were negligible: less than one check-up per year each, with no treatments or prescriptions. They were covered by insurance, but even if paid out of pocket, this would have averaged to under $200 per year.

- In 2006, the birth of the boy and related issues racked up a bill of about $20,000 (a routine surgical intervention was needed, ?quadrupling the cost), $4,500 of which we had to pay ourselves.

- From 2006 to the present, we have averaged one doctor checkup each per year, plus one antibiotic prescription per year between us, which if paid out of pocket would have cost about $600 per year.

Total medical spending (mostly covered by insurance): about $25,000

Total premiums paid by from employers to insurance companies on our behalf: about $100,000

Hey, there?s an unexpected result! We took a 12-year period which included the once-in-a-lifetime (for us) event of a hospital birth of a baby with added surgery, and it still ended up that the insurance premiums were about four times higher than the insurance benefits. This told me that I should probably shop carefully for insurance, in order to get something that protects me from those million-dollar illnesses, but does not attempt to pay for any hundred-dollar incidents, since the cost for that extra protection is clearly very high.

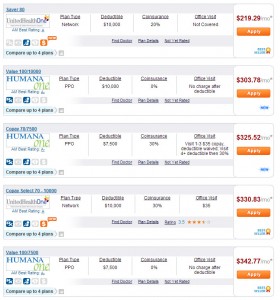

The next stop was an insurance comparison engine. We used ehealthinsurance.com* to do this search, which allowed me to see offerings from the companies that compete specifically in my area ? sorted by price. I was pleased to note that prices drop rapidly as the annual deductible rises ? meaning most health care expenses are statistically the lower cost ones, and the million-dollar illnesses are indeed very rare (otherwise the premiums would be different).

The winning plan for us was one called the ?Saver80 United Health One? plan from United Healthcare, with a quoted price of $219/month** for the family (two 38-year-old adults and a 6-year old boy). The price is low because it comes with a relatively whopping $10,000 per-person/ $20k-per-family deductible, meaning we are very unlikely to ever use this coverage. But at the same time, covering $10-20k in the event of a catastrophe would not be a significant hardship for us, especially given that this is an unlikely event. Even if the expense were to reoccur annually for decades, we could adjust our lifestyle as needed, or earn more income, or get a job with insurance coverage, or make any number of other changes ? assuming we even survived that long with such a serious condition. So it passes the test of putting a safe cap on expenses.

All plans these days also provide one free checkup (or ?annual physical?) doctor visit per year, with no copay or deductible at all. The value of this alone is worth 10-15% of the annual premium of our new plan.

The Quote Process:

Here?s a screenshot of the quote comparison on ehealthinsurance.com

We also decided to search directly through United Healthcare and received nearly the same quote from them:

This particular plan does not team up with a ?Health Savings Account? (HSA). I do like the idea of such an account, because you can put pre-tax money into it over time, then spend it on health expenses without penalty. But my tax rate is already low, and investment options may be limited within an HSA (note that some readers have mastered this issue and do fine with the accounts ? see the comments below). I probably do better keeping my cash invested in stocks and real estate, where I earn over 7% in the long run, than in a cash-based investment in an HSA, with yields on cash near zero these days. The biggest issue in my case was that the HSA-friendly plans were at least $100 per month more than non-HSA for equivalent coverage, negating any possible savings.? The ?HSA 100? quote from United (see image above) is $393 per month.

The most illuminating part was comparing our new high-deductible plan to the old one that has covered us since 2005:

| Old Plan | New Plan | |

|---|---|---|

| Monthly fee | $1,218.06 | $236.81 |

| Deductible (individual) | $1,000 | $10,000 |

| Deductible (family) | $3,000 | $20,000 |

| Out of Pocket Max (individual) | $3,000 | $3,000 |

| Out of Pocket Max (family) | $6,000 | $9,000 |

| Coinsurance | 80/20 | 80/20 |

| Doctor Copay (annual checkup) | $0 | $0 |

| Doctor Copay (other visits) | $25 | n/a (not covered) |

| Specialist Copay | $50 | n/a (not covered) |

| Emergency Room Copay | $250 | n/a (20% after deductible) |

| Urgent Care Co-Pay | $75 | |

| Annual cost (including base premiums) if everything is maxed out for one individual | $18,616.72 + copays | $15,841.72 |

| Annual cost if everything is maxed out for family | $23,616.72 + copays | $31,841.72 |

See, our old insurance was fine, but it was still far from Cadillac. With their various loopholes, you still have to pay the first several thousand dollars of any sort of surgery, which is a good part of fixing your own broken arm anyway. And yet it was six times more expensive, at over $14,600/year for our family.

We also calculated how much we would have to pay out of pocket in a year under the very worst situation. These results are shown in the last two rows of the table.

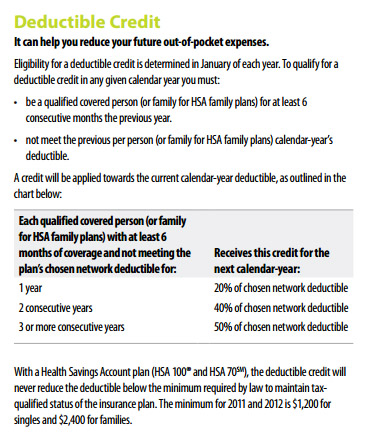

On top of this, the deductible for our new plan drops each year that you don?t make insurance claims. After three years, it will already be down from $10,000 to $5,000 per individual, thanks to the Deductible Credit, which means last two rows of the table above start looking even better.

Deductible Credit Info from the United HealthCare Web Site:

Doing the math, there are very few situations in which the more expensive insurance would be a good buy. Under the current regime, we save almost $12,000 in premiums every year, just for coverage of doctor visits and a lower deductible on major care. I?d have to immediately get a chronic heart condition or cancer, or be a member of the crew of the Jackass TV show to end up saving money in the greater coverage case.

And there are greater savings out there for the self-insured. I recently got an elective procedure done (the one a man must do when he requires no more children) while under the old insurance. But I asked the doctor first, if there is any difference in the cost if a patient is paying out of their own pocket. His answer was quite interesting:

?Oh yeah! If you?re not going through insurance, we can do it right here in the office, and the cost is $600. If you use insurance, they insist that we do it in the Surgery center across the street because of legal reasons, and it costs an extra $250 there, plus the scheduling takes a month longer?.

Since the cost was less than my old deductible, there was absolutely no reason not to self-pay. This got me thinking even more. I called around to several clinics in my area and asked for their ?self-pay? price for the same procedure. The prices ranged from $500 to $1000. It turns out that healthcare is indeed a competitive market, if you bother to ask. The same applies to prescription pricing: you will probably pay much less at Wal-mart?s pharmacy than at Walgreens. In the end, I chose the original doctor because he was the closest to home, but after the search I will never view costs as a fixed thing again.

In the end, we got through the labyrinth with a newfound understanding and a sense of relief. Health insurance is not scary after all. All of us have different situations ? if you have a pre-existing condition, the insurance calculations will be different. If there are children planned in your future, the math changes yet again. And if you don?t live in the United States, none of this may matter at all!

And it?s all changing in the near future again. Starting in 2014, the Affordable Care Act begins to shift the balance towards fuller coverage for all. Plans like mine with very high deductibles will phase out (although existing plans will be grandfathered in), meaning you will have to get more coverage and pay more for it. Balancing that out, however, are subsidies that will offset most or all of the extra cost for Mustachian-level early retirees, so the end result could be getting better coverage at similar cost. When you combine this with the new much-better options for people with pre-existing conditions, the ACA provides a serious boost to entrepreneurs and aspiring early retirees alike, because the risk of unexpected medical costs is greatly reduced. Thus, fewer people will feel trapped in large company jobs simply because of the health insurance they provide.

Karawynn at the blog called Pocketmint wrote a great post on this issue here.

Medical insurance is a complicated field, but the MMM family is feeling nicely set for now. If it changes, we?ll re-evaluate and act as needed. The bottom line is that the issue of health insurance does not need to get in the way of early retirement for most of us. And the more you learn about it when the time comes, the better you?ll do.

?

* The ehealthinsurance.com link is an affiliate link, so if you end up using it for your own insurance shopping, this blog will benefit (and thanks!).

**-?after applying for the plan, you fill out a detailed survey about past health conditions online. After hearing about the more costly birth of our son, they raised the rate by $18/month over the original quote to that $237/month you see in the article title. Probably because any additional births are more likely to be high-cost as well. In this case, it would be good if information were more transparent, since we should actually get a discount rather than a penalty due to the fact that there will be no additional MMM children!

Earn Fifty Bucks Right Now:

Welcome New Readers! Take a look around. Feeling Hardcore? Start at the first article and read your way through using the links at the bottom of each article. Casual Sampler? Browse the complete list of all posts since the beginning of time. Hope to see you around here more often.

Where to next? Check out a Random Article

Source: http://www.mrmoneymustache.com/2012/11/01/our-new-237-per-month-health-insurance-plan/

joe arpaio cat in the hat green eggs and ham wiz khalifa and amber rose oh the places you ll go blunt amendment justin bieber birthday

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.